Friday, September 21, 2012

7 Steps For A Successful 1031 Tax Deferred Exchange

A 1031 exchange is a tax-deferred exchange which allows an owner of business or investment property to exchange that property for new property without incurring income tax on the gain.

Thursday, September 6, 2012

Top 10 Things to Know About Real Estate Today

10. Distressed Properties: Short Sales and Bank Foreclosures (REOs) are not for everyone: Hurdles to Overcome:

- “As is” property condition

- Increased paperwork & complexity

- Increased chance for multiple offers

- Bank REO process is long & arduous

- Buyer probably is not getting a “steal”

- Buyer must be patient

9. “Aging in Place”

Did you know?

- Half of older women age 75+ live alone.

- Persons reaching age 65 have an average life expectancy of an additional 18.1 years.

- The 85+ population is projected to increase from 4.6 million in 2002 to 9.6 million in 2030.

- Median # of years home owners are staying in their homes has increased from 8 to 10 yrs.

8. Today’s Agent Must be Tech Savvy

Every source was used less except one – the Realtor!

7. Down Payments of 5% or Less Have NOT Disappeared

- Both first-time and repeat buyers are putting less than 20% down, even though a down payment of 20% will typically provide the best financing terms.

- 68% of first-time buyers and 28% of repeat buyers had a down payment of 5% or less in 2011.

6. Yes, it’s Still the Economy

- Employment will remain a challenge over the next few years, which impacts the market by tempering GDP and holding back demand for home buying.

- To get back to 6% unemployment, 13.3 million jobs need to be added over the next 3 years. That’s 400,000 jobs/month.

5. Condition is the Key for Serious Buyers

- Homes in better condition sold for an average of 96% of list price compared to 92% of list price for homes in poorer condition.

- The most common updates are: Paint (44%), Floorings (25%), and Lighting Fixtures (20%)

4. Home Staging is Well Worth the Effort

- Staged Homes sell faster.

- Staged homes get higher offers.

- Staged houses look better in the MLS pictures, getting more potential buyers to actually come see the house in the first place.

- Staged houses have an edge over competing properties, and the staging can often sway the final decision.

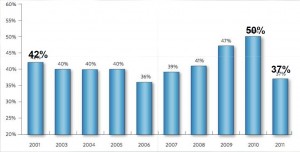

3. It’s Been a Great Market for First-Time Home Buyers

2. Price it Right the First Time!

- For the 48% of sellers who set their listing price according to their agent’s interpretation of the market value of their house:

• Sold faster – 56 days compared to 105

• Sold for 6.7% higher list

• Experienced fewer price reductions (4 to 6 weeks between price reductions of between $5,000 and $15,000)

1. The End is in Sight – We Have “Hit Bottom”

- We have been in a Buyer’s Market for the last 6 years because: home prices have been low, mortgage rates are at an all-time low, and inventory has been high.

- Prices have stabilized (we’ve had our pricing correction), it doesn’t seem likely that interest rates can go any lower and we are reaching an inventory balance.

We are not fortune tellers, but we have been through enough up and down markets to recognize the signs of recovery…and we’re seeing a lot of them right now!

Saturday, September 1, 2012

40 Easy Ways To Go Greener At Home

There are many little things we can do in our homes to play a small part in reducing landfill waste, cleaning the air, and preserving the natural landscape. The thing we love most about practicing green alternatives in our homes is that nine times out of ten, they are the more frugal option. And we love to be frugal and help people save money! Being environmentally-friendly is just good economics - in our home and budget and with the earth.

Here are 40 Easy Ways to Go Greener ....

Here are 40 Easy Ways to Go Greener ....

1. Plant an herb garden. It’s good to have a reminder around of where our food originates, and this one is super easy.

2. Switch all your lightbulbs to CFLs (or at least switch a few).

4. Switch one appliance to an energy efficient model (look for the “energy star” label).

5. Stop using disposable bags. Order some reusable bags—one of our favorite can be found at Flip & Tumble. Or, make your own—they’re insanely easy.

6. Buy an inexpensive reusable water bottle, and stop buying plastic disposable bottles. Then watch The Story of Bottled Water, a short movie about the bottled water phenomena.

7. Wash laundry in cold water instead of hot.

8. Turn off lights when you leave the room.

9. Don’t turn on lights at all for as long as you can—open your curtains and enjoy natural light.

10. Drive the speed limit, and combine all your errands for the week in one trip.

11. Better yet, walk or ride a bike to your errands that are two miles or closer.

12. Support your local economy and shop at your farmer’s market.

13. Turn off your computer completely at night.

14. Research whether you can sign up for green power from your utility company.

15. Pay your bills online. Not only is it greener, it’s a sanity saver.

16. Put a stop to unsolicited mail — sign up to opt out of pre-screened credit card offers. While you’re at it, go ahead and make sure you’re on the “do not call” list, just to make your life more peaceful.

17. Reuse scrap paper. Print on two sides, or let your kids color on the back side of used paper.

18. Conduct a quick energy audit of your home.

19. Subscribe to good eco-friendly blogs. A couple of our favorites are Keeper of the Home, Kitchen Stewardship, Live Renewed, and of course, Simple Homemade.

20. Before buying anything new, first check your local Craigslist or Freecycle.

21. Support local restaurants that use food derived less than 100 miles away, and learn more about the benefits of eating locally.

22. Fix leaky faucets.

23. Make your own household cleaners. Here are quite a few recipes in this book.

25. Watch The Story of Stuff with your kids, and talk about the impact your household trash has on our landfills.

26. Learn with your kids about another country or culture, expanding your knowledge to other sides of the world.

28. Lower the temperature on your hot water heater.

29. Unplug unused chargers and appliances.

30. Repurpose something. It’s fun.

31. Collect rainwater, and use it to water your houseplants and garden.

32. Switch to cloth diapers – or at least do a combination with disposables. Even one cloth diaper per day means 365 fewer disposables in the landfill each year.

33. Switch to shade-grown coffee with the “Fair Trade” label.

34. Use a Diva Cup for your monthly cycles. At the risk of TMI, I’ve been using mine for more than five years now.

35. Use cloth instead of paper to clean your kitchen. Be frugal, and make these rags out of old towels and t-shirts.

36. Use cloth napkins daily instead of paper.

37. Read Animal, Vegetable, Miracle, and be utterly inspired.

38. Repurpose glass jars as leftover containers and bulk storage, especially in the kitchen.

39. Watch the myriad documentaries on Netflix about the food industry. Some of our favorites are Food Inc., Fresh, and What’s on Your Plate?.

40. Donate to—and shop at—thrift stores. You’ll be recycling perfectly usable items, you’ll be supporting your local economy, and you’ll be saving money.

Help from Tsh at Simple Living Media

Subscribe to:

Posts (Atom)